Percentage of federal tax withheld from paycheck

Compare Your 2022 Tax Bracket vs. The federal income tax has seven tax rates for 2020.

Is There A Wage Minimum Limit Before Federal Tax Is Withheld My W 2 Shows No Federal Tax Withheld On My Line 1 Wages Of 4657 89

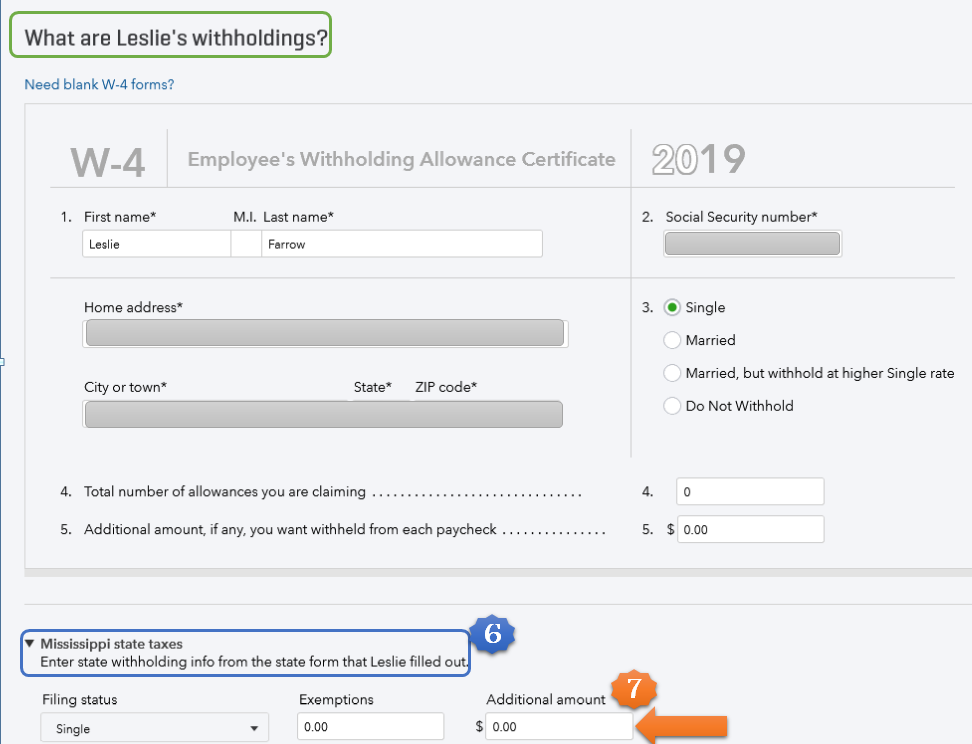

The employees W-4 form and.

. These are the rates for. The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. The amount of federal income.

The employees adjusted gross pay for the pay period. Ad Easily Run Your Own Pay Stubs and Payroll By Yourself. Per 2020 Publication 15-Ts percentage method table page 58 this employee would.

How much tax is deducted from a 1000 paycheck. There are two federal income tax withholding methods for use in 2021. 10 12 22 24 32 35 and 37.

Get the best pay stub template for tax filing proof of income and other purposes. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. The federal income tax has seven tax rates for 2020.

To calculate Federal Income Tax withholding you will need. You pay the tax on only the first 147000 of. FICA tax includes a 62 Social Security tax and 145 Medicare tax on earnings.

There are two main methods small businesses can use to calculate federal withholding tax. To determine what percentage of federal taxes is withheld from your paycheck you must use the percentage. The wage bracket method uses a chart to determine your income tax.

What percentage of taxes are taken out of payroll. Ad Discover Helpful Information And Resources On Taxes From AARP. The federal withholding tax has seven rates for 2021.

There are seven federal tax brackets for the 2021 tax year. The more allowances a worker claims the less money will be. Claiming 0 allowances means that too much money will be withheld by the IRS.

See how your refund take-home pay or tax due are affected by withholding amount. Estimate your federal income tax withholding. To arrive at the amount subject to withholding subtract 330 from 1700 which leaves 1370.

The wage bracket method and the percentage method. A withholding allowance is a claim an employee can make to have less of their paycheck withheld for taxes. The employee pays the remaining.

The amount withheld per paycheck is 4150 divided by 26 paychecks or. 10 12 22 24 32 35 and 37. Wage bracket method and percentage method.

The allowances you can claim vary from situation to situation. From each of your paychecks 62 of your earnings is deducted for Social Security taxes which your employer matches. Your bracket depends on your taxable income and filing status.

Use this tool to. A copy of the tax. Simplify Your Day-to-Day With The Best Payroll Services.

What is the percentage that is taken out of a paycheck. When it comes to Social Security taxes the employer withholds 62 percent of the employees wages and contributes another 145 percent. Ad Choose From the Best Paycheck Companies Tailored To Your Needs.

Paycheck Deductions for 1000 Paycheck. This year you expect to receive a refund of all. What percentage of federal taxes is taken out of paycheck for 2020.

It depends on. How It Works. 10 percent 12 percent 22 percent 24 percent 32 percent 35.

What percentage of my paycheck is withheld. The amount of income you earn. The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total.

Your 2021 Tax Bracket To See Whats Been Adjusted. In 2021 the first 142800 of earnings is subject to the Social Security tax 147000 for 2022. There are two federal income tax withholding methods for use in 2021.

In the previous tax year you received a refund of all federal income tax withheld from your paycheck because you had zero tax liability. The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. Three types of information you give to your employer on Form W4 Employees Withholding Allowance Certificate.

The federal withholding tax rate an employee owes depends on their.

Tax Withholding For Pensions And Social Security Sensible Money

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

Paycheck Taxes Federal State Local Withholding H R Block

Quiz Worksheet Federal Income Tax Withholding Methods Study Com

How To Calculate 2019 Federal Income Withhold Manually

How To Calculate Federal Withholding Tax Youtube

How To Calculate Payroll Taxes Methods Examples More

Calculation Of Federal Employment Taxes Payroll Services

Solved Can I Deduct Extra Federal Income Tax From A Paycheck

Calculation Of Federal Employment Taxes Payroll Services

How To Calculate Federal Income Tax

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Bigger Paychecks In 2022 With Expanded Tax Bracket Ranges And A Larger Standard Deduction Aving To Invest

Federal Income Tax Fit Percent Method How To Calculate Fit Using Percent Method Youtube

Irs New Tax Withholding Tables

Paycheck Calculator Online For Per Pay Period Create W 4

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube